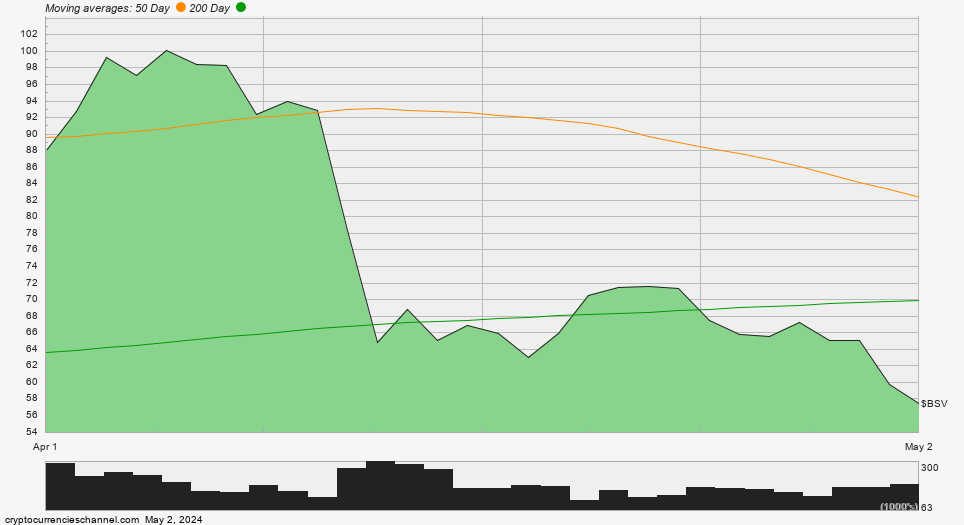

What is the recent price quote for Bitcoin SV?

How much is one Bitcoin SV in US dollars?

✔️Accepted answer:

As of 4/18/2024, one coin trades at about 63.12 US dollars for Bitcoin SV.

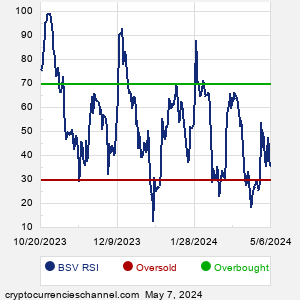

Is Bitcoin SV oversold or overbought?

Using the RSI indicator, where does Bitcoin SV stand?

✔️Accepted answer:

For digital asset traders who incorporate Technical Analysis into their strategies, one of the popular historical price chart tools is the Relative Strength Index (RSI). This popular indicator, originally developed for stock market analysis in the 1970's by J. Welles Wilder, looks at a 14-day moving average of an asset's gains on its up days, versus its losses on its down days. The result is a value that measures momentum, oscillating between "oversold" and "overbought" on a scale of zero to 100. A reading below 30 is viewed to be oversold, which a bullish investor could look to as a sign that the selling is in the process of exhausting itself, and look for entry point opportunities. A reading above 70 is viewed to be overbought, which could indicate that a rally in progress is starting to get crowded with buyers. If the rally has been a long one, that could be a sign that a pullback is overdue. We calculate the current RSI value for Bitcoin SV to be 18.28 as of 4/18/2024.

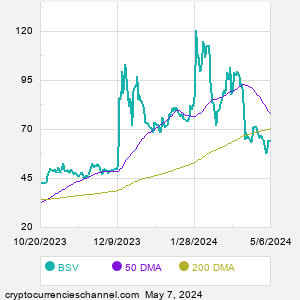

What is the current DMA for Bitcoin SV?

DMA meaning daily moving average, with Bitcoin SV historical price chart moving average periods of 50 and 200?

✔️Accepted answer:

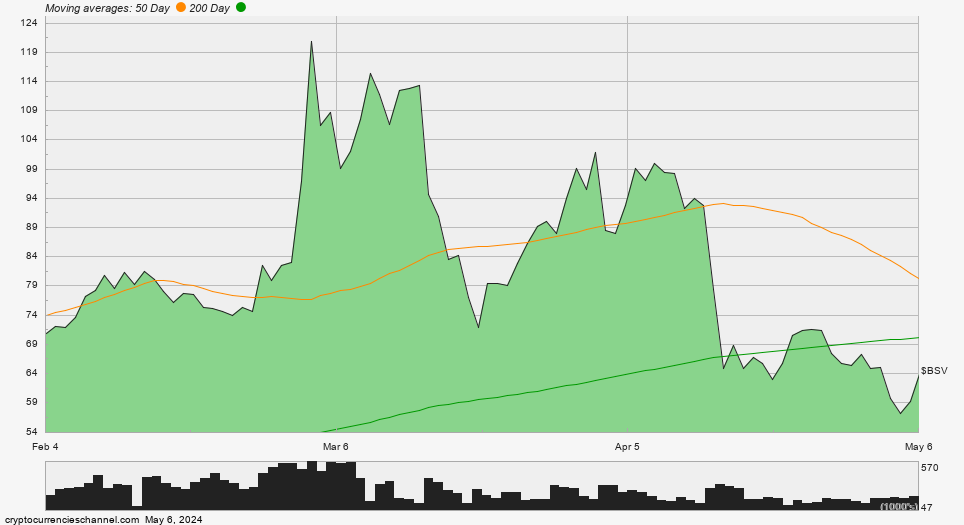

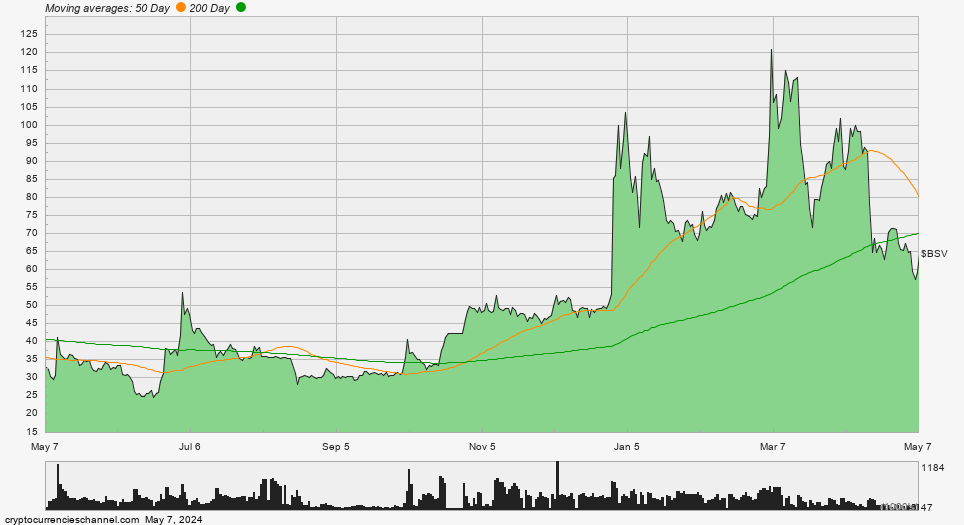

One of the popular technical analysis tools is to calculate a Simple Moving Average (SMA), with a look-back of either a shorter or longer term period — with popular periods being the 50 day moving average ("50 DMA") for the shorter period, and the 200 day moving average ("200 DMA") for the longer period. We calculate the current 50 DMA for Bitcoin SV to be 91.72, and the current 200 DMA for Bitcoin SV to be 68.14 as of 4/18/2024.

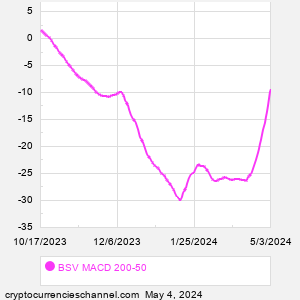

What is Bitcoin SV's MACD based on its DMA values?

MACD referring to the moving average convergence / divergence indicator.

✔️Accepted answer:

For the 50 DMA and 200 DMA discussed above, the current MACD is -23.58 based on the Bitcoin SV historical price chart as of 4/18/2024.